यस्तै हो भने फेरि सभापति उठ्छु: देउवा

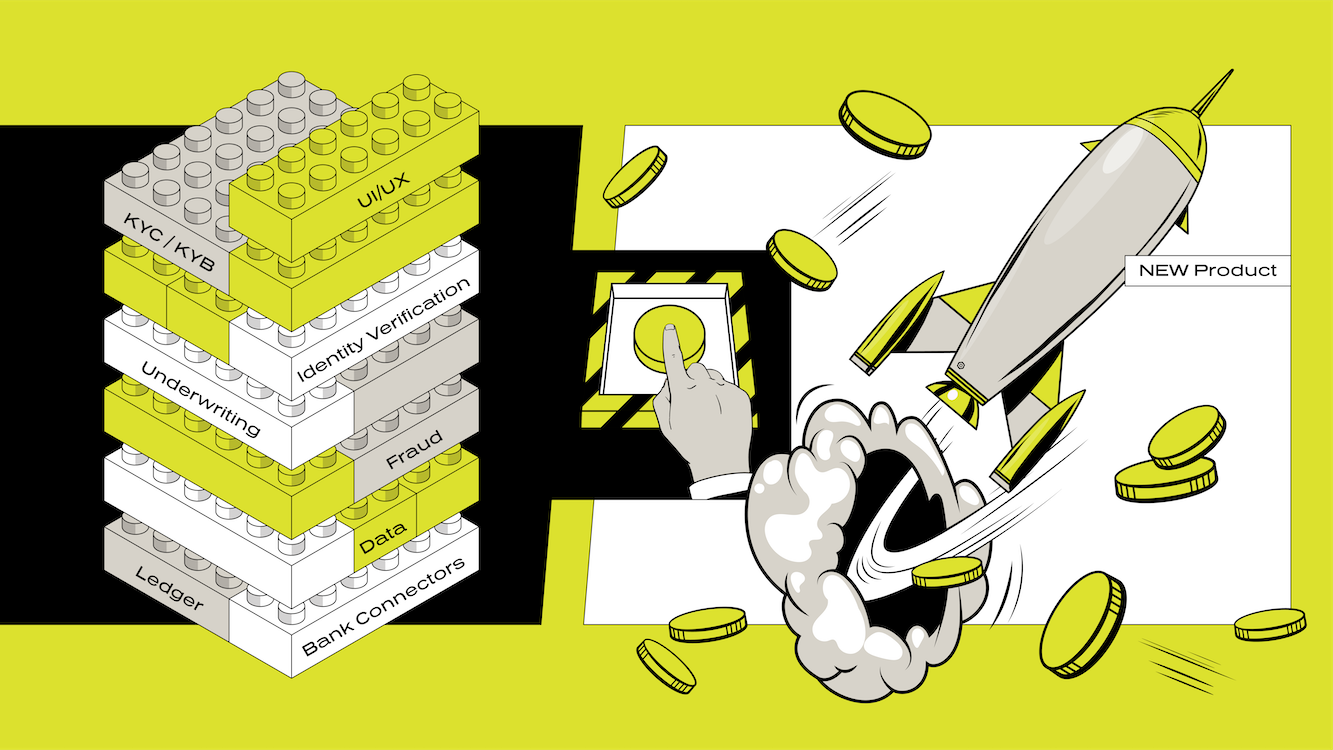

It’s extremely difficult to get a banking license in the U.S.—short of buying a bank—so most fintechs could not legally operate without partnering with a regulated entity. The second is that consumer fintechs, because they aren’t banks, can’t rely on a net interest margin business model and instead rely heavily on interchange fees to make money. ......... By partnering with smaller banks, fintechs could bypass licensing logistics and benefit from the higher interchange, creating fertile ground for fintech growth. The partner bank model was born: small banks lend out their charters to powerful fintech players. This allows fintech companies to offer financial products legally while also driving deposit and revenue growth for the partner banks. In fact, these banks consistently have better ROE and ROA metrics than the industry average. ....... Fintechs needed to build secure infrastructure that would allow their modern platforms to speak to bank back-end systems (many of which are still run on mainframes and rely on COBOL, a dying programming language popular in the 1960s), as well as meet compliance requirements. As a result, most early fintechs found themselves spending up to two years—and millions of dollars—just building connections into their partner banks’ legacy infrastructure. .......... Because partnering banks don’t have internal software development muscle, nearly all of the building burden fell on the startups—and this is where another significant pivot happened. Realizing the broad applicability of the pain they experienced, many of the startups that started out as direct-to-consumer service models shifted to become infrastructure businesses and provide what they’d built to other companies looking to offer financial services. For example, Marqeta started as a pre-paid gift card business before it moved into card issuing as a service. It wasn’t long before these re-imagined fintechs realized that there was (and is) enough breadth in the fintech ecosystem that they can thrive in serving other fintechs, not just banks—which are typically painful to sell to. .......... Fast forward to today, there is now a robust toolkit of fintech infrastructure players that are API-first and developer-focused for anyone looking to build financial products. Their services include data aggregation, identity verification, know-your-customer/anti-money laundering (KYC / AML), card issuing, banking as-a-service, among others. With all the innovation on the infrastructure layer, there now exists a set of modular lego boxes that can be recombined to create new financial products and experiences.

In an interview with @Olivianuzzi, Donald Trump says it's a matter of when — not if — he'll formally announce a 2024 run https://t.co/Iq1EqcQq6H

— New York Magazine (@NYMag) July 14, 2022

#KanganaRanaut plays the role of former Prime Minister #IndiraGandhi in #Emergency. Apart from acting, Kangana also directs the film.https://t.co/GnbDcMwhaF

— The Hindu Cinema (@TheHinduCinema) July 14, 2022

Greatest Actress Of India Presenting Kangana Ranaut as PM Indira Gandhi

— Pooja #Tejas ✈️On 5th October 🇮🇳 (@PoojaKRFan) July 14, 2022

Literally No Words Unbelievable 🔥 #KanganaRanaut #Emergency #IndiraGandhi #EmergencyFirstLook #ManikarnikaFilms 😇 pic.twitter.com/nHJRcYjEDx

Uncanny Resemblance.She never fails to amaze me such a dedicated artist ❤ #KanganaRanaut pic.twitter.com/Rh7MjutzS4

— Kaveesha (@KaveeshaShah) July 14, 2022

How can a same actress play these 2 different characters!!!

— 🍁Folk Life🍁 (@folk_life) July 14, 2022

Jayalalitha & Indira Gandhi have completely different features!

Only #KanganaRanaut can make it happen... bravo 👏🏻 👏🏻 👏🏻 #EmergencyFirstLook pic.twitter.com/7BLW8nReLw

#KanganaRanaut portrayed #jayalalitha in #Thalaivi and now as #IndiraGandhi in #Emergency 🔥🔥 pic.twitter.com/ckf4m6roku

— Sundar 🏳️🌈 (@sylviareydel) July 14, 2022

15 Years in.. 4 National Awards and Countless Acting Accolades .. AND yet.. to this day when she acts, my jaw hits the floor..every film she transforms like a mutant... A LEGEND OF THE SCREEN #KanganaRanaut #Emergency pic.twitter.com/aNT4deljCY

— 𝐍𝐚𝐯𝐢 (@NaviKRStan) July 14, 2022

#KanganaRanaut getting into the skin of the character. She looks like a spitting image of Mrs. Indira Gandhi here… nicely done 👍🏻#Emergency pic.twitter.com/bHLUgXetsr

— Griha Atul (@GrihaAtul) July 14, 2022

How the Durbin Amendment sparked fintech innovation the idea is that a movement meant to instill change for a specific purpose yields changes, unexpectedly, somewhere else. One of the best examples of this in fintech is the unanticipated consequences of the Durbin Amendment, a 2010 legislation that is making waves in the startup world more than a decade later. ......... a Senator’s bid to protect the people birthed the modern fintech industry as we know it today ........ By June 2009, only 22% of Americans surveyed said they had confidence in banks. ....... professionals departed struggling financial institutions in droves, flooding the talent market. While they might have been done with big banks, many recognized the value of joining their expertise with technology startups—or founding their own. ......... It’s expensive for banks to service deposits. The annual cost to a bank of servicing a checking account is $250-400 a year. These high fixed costs render about 40% of checking accounts unprofitable. .......... Non-finserv companies such as marketplaces, social platforms, and software providers can offer financial services through third-party partners without being subject to direct regulations. These products tend to be of higher quality, more tailored to individual needs, and more affordable. Traditional banking institutions, facing robust competition, have been forced to modernize their tech stacks and business models.